US Jobs Report: Hiring Slows, India IT Sector Watches

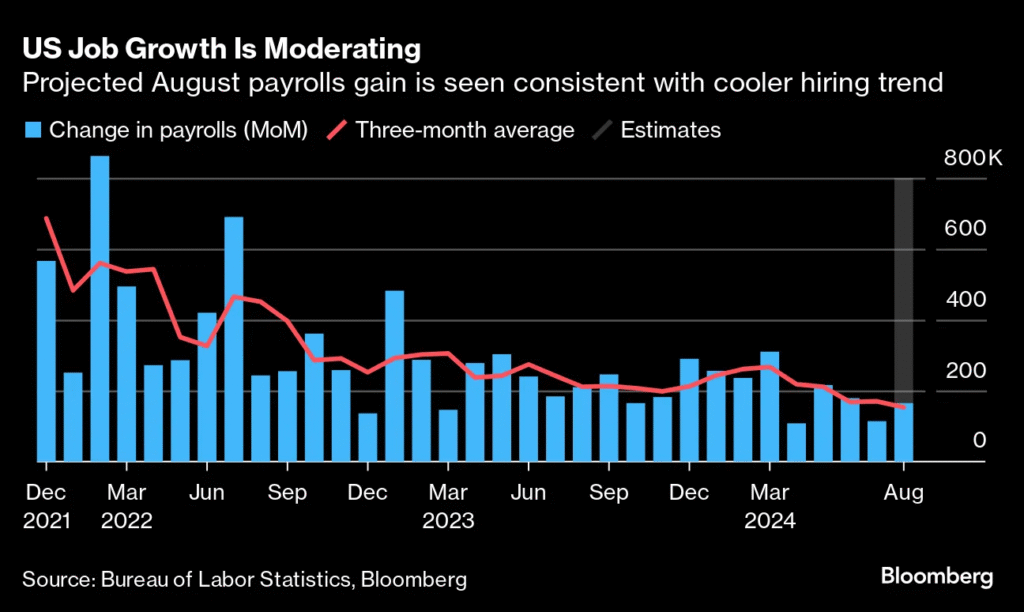

The closely watched May 2024 US jobs report reveals a significant slowdown in hiring, with just 175,000 jobs added – far below April’s 315,000. This cooling labor market signals potential relief for inflation but raises concerns for India’s IT sector, which relies heavily on US contracts. As unemployment ticks up to 3.9% and wage growth eases, the data intensifies the Federal Reserve’s rate-cut debate – a decision with major implications for India’s economy and job market.

Key Findings from May’s Report

(Source: U.S. Bureau of Labor Statistics)

- Job Gains: 175,000 (lowest since Oct 2023)

- Unemployment Rate: Rose to 3.9% from 3.8%

- Wage Growth: Slowed to 3.9% YoY (down from 4.1%)

- Sector Leaders: Healthcare (+68k), Government (+43k)

- Sector Laggards: Retail (-9k), Temporary Help Services (-14k)

Why India’s Tech Sector Is Concerned

The slowdown triggers red flags for Indian IT firms:

- Project Delays: US clients may freeze discretionary spending

- Hiring Caution: TCS, Infosys already reduced campus offers by 25% YoY

- Revenue Impact: 60-70% of Top 5 IT firms’ revenue comes from US

“BFSI and retail clients are reprioritizing budgets,” warns Nasscom VP Ashish Aggarwal.

Fed Rate Cut Implications for India

The soft report boosts chances of 2024 rate cuts:

- Rupee Boost: Faster Fed cuts could strengthen INR against USD

- FDI Flows: Lower US yields may redirect investments to India

- Borrowing Costs: Potential relief for Indian firms with dollar debt

*Market odds for Sept rate cut jumped to 65% post-report (CME FedWatch Tool)*

Mixed Signals: Not All Doom for India

Positive ripple effects could emerge:

- Offshoring Push: US firms may accelerate India-based outsourcing to cut costs

- Inflation Control: Lower US demand helps ease global commodity prices

- Talent Repatriation: Weakening US job market may bring back Indian tech talent

What Economists Are Saying

- Radhika Rao (DBS Bank): “Delayed Fed cuts may prolong tight liquidity for Indian startups.”

- Madhavi Arora (Emkay Global): “Rupee could test 82/USD if Fed pivots by Q4.”

- US Treasury Secretary Yellen: “Labor market normalizing sustainably”

Future Outlook: India-Specific Impacts

- IT Sector: Bench strength expansions likely paused; focus on efficiency

- NRI Remittances: Potential dip if US wage growth stagnates

- Equity Markets: Indian IT stocks may underperform near-term

- Policy Response: RBI likely to maintain status quo until Fed moves

Summary

May’s cooler US jobs report offers mixed blessings for India. While easing inflation pressures could accelerate Fed rate cuts – boosting the rupee and foreign inflows – India’s IT sector faces immediate headwinds from tightening US budgets. With the unemployment rate rising and wage growth slowing, Indian policymakers and export-dependent industries must brace for volatility while positioning for long-term opportunities in a recalibrating global economy.

No responses yet