Bobby Bonilla Day: $1.19M for Not Playing!.Bonilla was one of MLB’s best batters and overall top players in the late 1980s and early 1990s with powerful hitting strength as well as a part of the highly successful and pennant contending organization around the same time

Every July 1st, baseball fans worldwide celebrate “Bobby Bonilla Day” – the day a retired player collects a jaw-dropping $1.19 million from the New York Mets for not playing since 2001. This quirky financial tradition, trending globally, highlights one of sports’ most infamous deferred contracts. For India’s business and cricket communities, it’s a masterclass in long-term financial planning (or costly miscalculation) with striking parallels to modern athlete deals.

What is Bobby Bonilla Day?

On July 1, 2000, the Mets agreed to defer the $5.9 million owed to Bonilla by:

- Annual Payments: $1,193,248.20 every July 1 from 2011–2035

- Interest Rate: 8% annual (Mets bet investments would outperform this)

- Total Payout: $29.83 million for original $5.9M debt

Why Did the Mets Agree?

Desperate moves in 2000 drove the deal:

- Wanted to clear payroll for star signings (e.g., Mike Hampton)

- Owner Fred Wilpon’s investments with Bernie Madoff were yielding ~10% returns

- Fatal Flaw: Madoff’s Ponzi scheme collapsed in 2008, obliterating Wilpon’s wealth

The Math Behind the Madness

- Bonilla’s Gain: $29.83M total vs. $5.9M upfront (407% return)

- Mets’ Loss: Would’ve saved ~$26M paying in 2000 (per Forbes)

- Inflation Impact: $1.19M in 2035 ≈ $500k today (BLS data)

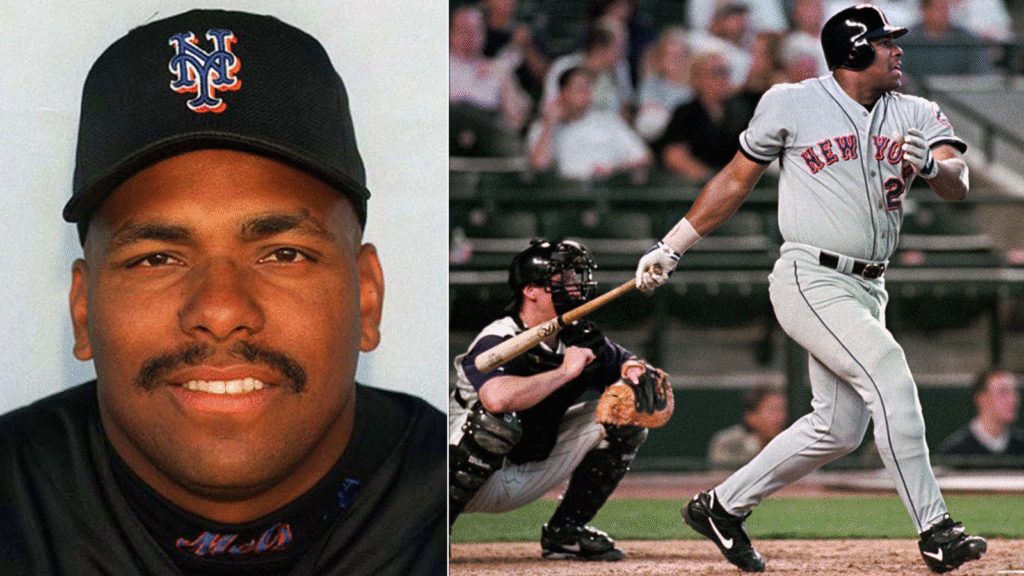

Bonilla’s Career in Brief

- MLB Tenure: 1986–2001 (Mets, Marlins, Dodgers, Orioles)

- Accolades: 6x All-Star, 3x Silver Slugger, 1997 World Series champ

- Career Earnings: $52M playing + $30M deferred = $82M+ total

Modern Deals: Bonilla’s Legacy

Deferred payments are now strategic:

- Mookie Betts: Dodgers defer $115M of $365M deal to 2033–2044

- IPL Parallels: Cricket stars like Dhoni take reduced upfront fees for backend equity

- Financial Wisdom: Protects athletes from post-career insolvency

Why India Should Care

- Business Lesson: High-risk leverage (like Madoff) can backfire catastrophically

- Cricket Contracts: BCCI/IPL could adopt similar long-term player security models

- Viral Finance: Sparks discussions on athlete wealth management

The Future of Deferred Pay

With interest rates rising, teams are wary. But experts say structured deferrals will continue for:

- Tax optimization (lower brackets post-retirement)

- Salary cap flexibility

- Franchise liquidity during economic uncertainty

Meta Description (153 chars): Why Bobby Bonilla gets $1.19M yearly from Mets 23 years after retiring? The wild deferred contract story explained. Lessons for sports biz!

No responses yet