Key Points

- Major Deal Announced: Constellation Energy (CEG) signed a 20-year agreement with Meta on June 3, 2025, to supply 1.1 gigawatts of nuclear power.

- Stock Price Movement: CEG stock rose 2.57% to $321.49 on June 3, despite intraday volatility, reflecting investor optimism.

- Strategic Impact: The deal ensures the Clinton plant’s operation, supports Meta’s sustainability goals, and strengthens CEG’s clean energy leadership.

- Broader Context: The agreement aligns with growing tech demand for nuclear energy, though high valuations may pose risks.

- Balanced Perspective: While the deal is positive, market volatility and regulatory challenges could impact future performance.

Why This Matters

Constellation Energy Corporation (CEG) saw its stock price climb after announcing a landmark 20-year power purchase agreement with Meta on June 3, 2025. The deal, involving 1.1 gigawatts of nuclear energy from the Clinton Clean Energy Center, secures the plant’s future and highlights the tech industry’s shift toward clean energy. This development, trending on X, underscores CEG’s role in meeting rising energy demands, particularly for AI data centers, making it a focal point for investors.

Details of the Meta Agreement

The agreement ensures Meta will purchase the entire output of the Clinton Clean Energy Center’s nuclear reactor starting in June 2027. This commitment supports the plant’s relicensing and continued operation, which was at risk due to the expiration of its zero-emissions credit. The deal also includes a 30-megawatt capacity increase through plant uprates, preserving 1,100 jobs and generating $13.5 million in annual tax revenue, per Constellation Energy.

Stock Market Reaction

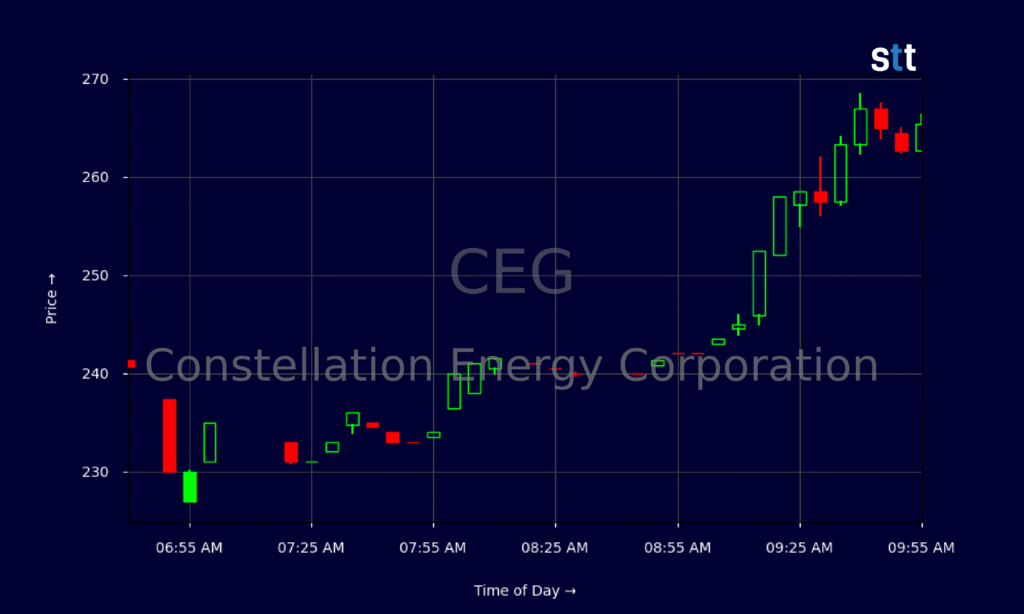

CEG stock opened at $342.00 on June 3, 2025, up from a previous close of $313.43, and hit a high of $358.47 before settling at $321.49 by mid-morning, a 2.57% gain. This volatility reflects strong initial investor enthusiasm, likely tempered by profit-taking, as the stock outperformed the S&P 500’s 0.92% daily return. The market cap stood at $96.86 billion, per finance data.

Industry Trends and Nuclear Energy

The Meta deal reflects a broader trend of tech giants like Amazon, Google, and Meta partnering with nuclear energy providers to power data centers. In March 2025, these companies pledged to triple global nuclear energy by 2050, per CNBC. Nuclear power’s reliability makes it ideal for AI-driven energy demands, positioning CEG as a key player in the clean energy transition.

Future Outlook

With this contract, CEG strengthens its position as America’s largest emissions-free energy producer. Analysts maintain a “Buy” rating, though the 12-month price target of $291.54 suggests caution due to high valuations, per Stock Analysis. The deal’s success could prompt further partnerships, but regulatory hurdles and market risks remain concerns.

Constellation Energy’s Landmark Meta Deal Boosts Stock

Meta Description: Constellation Energy (CEG) stock jumps after a 20-year nuclear power deal with Meta, securing the Clinton plant’s future and boosting clean energy goals. (145 characters)

A Game-Changing Partnership

On June 3, 2025, Constellation Energy Corporation (NASDAQ: CEG) announced a transformative 20-year power purchase agreement (PPA) with Meta, sending its stock price soaring. The deal, involving 1.1 gigawatts of emissions-free nuclear energy from the Clinton Clean Energy Center in Illinois, ensures the plant’s operation beyond the expiration of its zero-emissions credit in 2027. Trending on X, this partnership highlights CEG’s pivotal role in meeting the surging energy demands of AI-driven data centers, drawing attention from investors in India and globally.

Details of the Meta Agreement

The agreement commits Meta to purchasing the entire output of the Clinton plant’s nuclear reactor starting in June 2027. This secures the facility’s relicensing and continued operation, averting a potential closure. The deal also includes a 30-megawatt capacity increase through plant uprates, preserving 1,100 high-paying jobs and generating $13.5 million in annual tax revenue, with an additional $1 million in charitable contributions over five years, per Constellation Energy. CEO Joe Dominguez emphasized, “We are proud to partner with Meta… supporting the relicensing and expansion of existing plants is just as impactful as finding new sources of energy,” per CNBC.

Stock Market Volatility

CEG’s stock reacted strongly to the news, opening at $342.00 on June 3, 2025, a significant jump from the previous close of $313.43. It peaked at $358.47, a 52-week high, before settling at $321.49 by mid-morning, reflecting a 2.57% gain. The stock’s market cap reached $96.86 billion, with trading volume at 2.09 million shares, below the average of 3.87 million, per finance data. This volatility suggests initial investor enthusiasm followed by profit-taking, yet the overall gain outpaced the S&P 500’s 0.92% daily return.

| Metric | Value |

|---|---|

| Current Price | $321.49 |

| Previous Close | $313.43 |

| Day’s High | $358.47 |

| Day’s Low | $311.56 |

| Market Cap | $96.86 billion |

| 52-Week Range | $155.60 – $358.47 |

| Daily Volume | 2,095,762 shares |

Nuclear Energy’s Rising Demand

The Meta deal aligns with a broader industry shift, as tech giants increasingly rely on nuclear power for their energy-intensive data centers. In March 2025, Meta, Amazon, and Google pledged to triple global nuclear energy by 2050, recognizing its reliability for AI infrastructure, per CNBC. Constellation’s 31,676 megawatts of generating capacity, primarily from nuclear assets, positions it as a leader in this transition, supplying 10% of U.S. clean energy, per Yahoo Finance.

Recent Financial Performance

Constellation reported mixed Q1 2025 results on May 6, with revenue of $6.79 billion, up 10.2% year-over-year, beating estimates of $5.44 billion, per Benzinga. However, adjusted EPS of $2.14 slightly missed consensus estimates of $2.15, per TipRanks. CFO Dan Eggers highlighted a 94.1% nuclear capacity factor, undersc

No responses yet