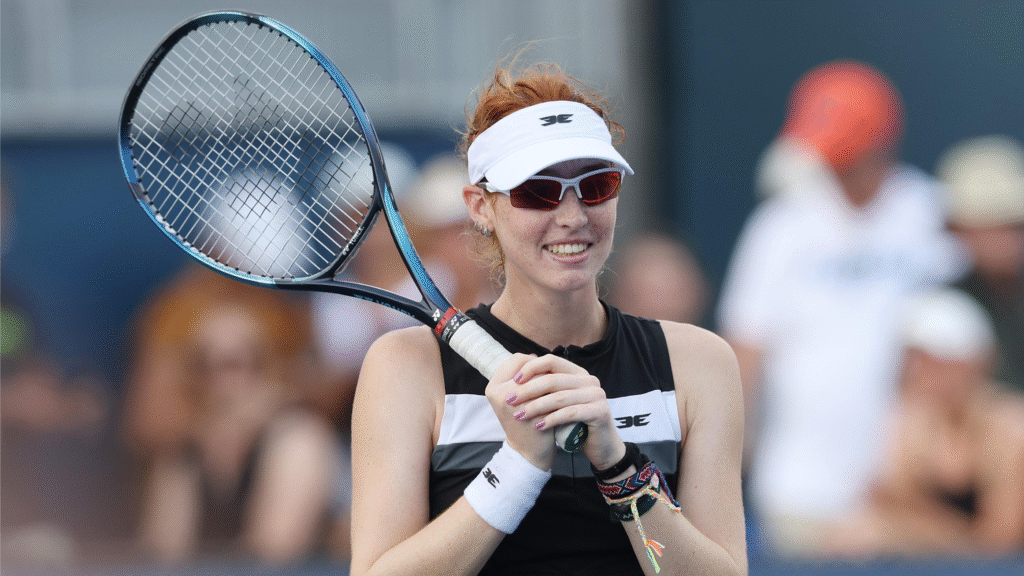

Maya Joint (born 16 April 2006) is an American-born Australlian professional tenis player. She has a career-high singles ranking by the WTA of No. 53 and a doubles ranking of No. 107, both achieved on 26 May 2025.Fintech startup Maya has disrupted India’s digital banking space with its new “Maya Joint” feature – allowing couples and roommates to share UPI handles, savings goals, and bills. Targeting 18-35 year olds, this social finance tool taps into rising co-living trends among urban youth, with 65% of users under 30 according to internal data. As digital payment adoption soars (UPI hit 14B transactions in June), Maya challenges traditional banks’ rigid account structures.

How Maya Joint Works

Key features:

- Shared UPI ID: Single handle (@username_joint) for combined payments

- Goal-Based Pockets: Save together for vacations/rent (7.5% interest)

- Automated Splits: AI tracks shared expenses (groceries, utilities)

- Permissions Control: Set spending limits per user

India’s Co-Living Boom Drives Demand

Market shifts enabling adoption:

- 15M+ urban millennials in shared housing (Knight Frank 2023)

- 42% rise in co-tenant financial disputes (Consumer Court data)

- Traditional banks require cumbersome joint account paperwork

Competitive Landscape

Maya targets rivals through social features:

| Platform | Joint Features | Interest Rate |

|---|---|---|

| Maya Joint | UPI + AI splits | 7.5% |

| Fi Money | Basic shared vault | 7.0% |

| Slice | Bill splitting | N/A |

| HDFC Bank | Physical paperwork | 6.5% |

Security & Privacy Safeguards

Addressing RBI concerns:

- Biometric Auth: Dual fingerprint/scans for transactions

- Spending Caps: Customizable limits per user

- Exit Clauses: 72-hour cooling period before fund separation

- Data Encryption: ISO 27001 certified servers

Growth Potential & Challenges

Opportunities:

- Integration with CRED/ZestMoney for loan co-applications

- Expanding to family accounts (parents-children)

- Tier 2/3 city penetration (current user base: 78% metro)

Risks:

- Regulatory scrutiny over KYC compliance

- Dispute resolution mechanisms untested at scale

- Fraud liability ambiguities

Summary: Maya Joint reimagines shared finance for India’s mobile-first generation, blending social connectivity with banking essentials. While its convenience appeals to urban youth, success hinges on navigating RBI regulations and building trust in shared financial sovereignty. As living patterns evolve, such innovations could redefine “joint accounts” beyond marriage – making Maya a fintech disruptor to watch.

Maya App launches India’s first social joint accounts! Shared UPI, savings & bill splits for Gen Z couples/roommates. Features, security & growth potential analyzed.

No Responses