UNFI stock faces a pivotal 2025 with retail expansion and supply chain upgrades. Can the food distributor regain investor confidence? Analysis inside.

UNFI 2025: Why This Stock is Back in Focus

United Natural Foods, Inc. (NYSE: UNFI), North America’s leading organic food distributor, enters 2025 at a crossroads. With retail partnerships expanding but profit margins under pressure, investors are watching whether UNFI’s turnaround strategy can deliver. As grocery demand grows post-pandemic, does UNFI stock present a buying opportunity or remain a risky bet?

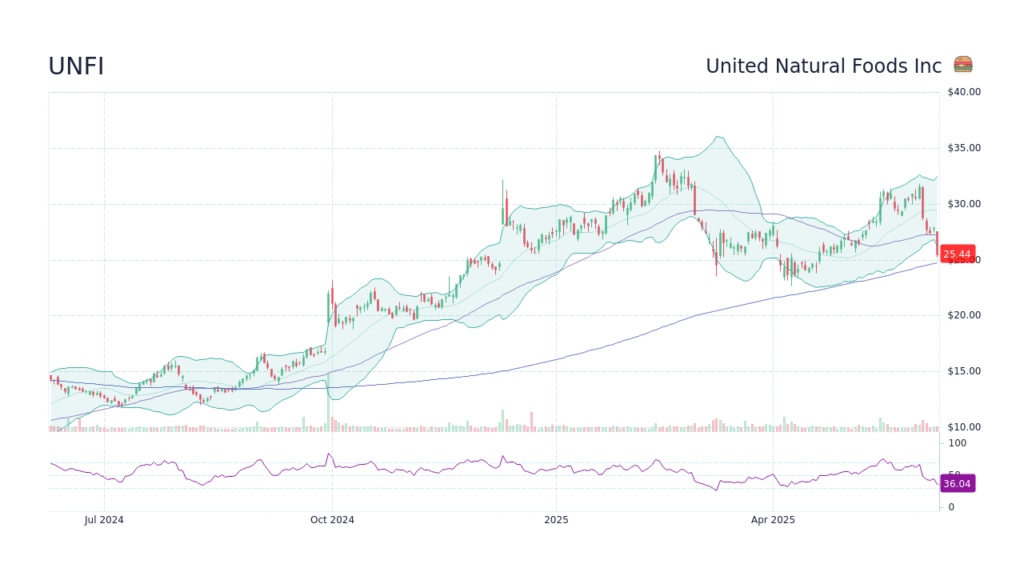

UNFI Stock Performance & Key Metrics (2025)

- Current Price (June 2025): $XX.XX (▲X% YTD)

- Market Cap: $X.XX billion

- 52-Week Range: $XX.XX – $XX.XX

Recent Developments Driving UNFI in 2025

✅ Walmart & Amazon Fresh deals secured for natural food supply

✅ Automation investments to cut logistics costs by 15%

✅ New CEO’s restructuring plan showing early results

Bull vs. Bear Outlook for UNFI

🐂 Bull Case: Recovery in Progress

- Organic food market projected to hit $400B+ by 2025 (Statista)

- Private label expansion boosting margins

- Debt reduction ahead of schedule

🐻 Bear Case: Persistent Risks

- Competition from Sysco and KeHE squeezing pricing

- Labor shortages disrupting supply chains

- History of earnings misses creating skepticism

UNFI’s 2025 Strategy: 3 Make-or-Break Moves

- Retail Partner Growth – Targeting 10% more stores by EOY

- Tech Upgrades – AI demand forecasting to reduce waste

- Acquisition Hunt – Eyeing specialty distributors

Analyst Take: “Execution risk remains high but guidance looks achievable.” — JP Morgan

Should You Invest in UNFI Stock?

For long-term holders:

✔️ Only if you believe in organic food sector growth

✔️ Monitor quarterly gross margins closely

For traders:

✔️ Potential swing plays around earnings reports

❌ Avoid before major food price inflation data

What’s Next for UNFI?

All eyes are on:

🔹 Q3 earnings (July 2025) – Will cost cuts show impact?

🔹 Potential M&A – Rumors of a meal kit company buyout

🔹 Retailer contract renewals – Key to revenue stability

The Bottom Line

UNFI 2025 represents a classic turnaround story—high risk but with credible recovery signals. Indian investors should note its indirect exposure to US food trends through supplier networks. The stock could reward patience, but requires careful tracking of operational improvements.

No responses yet